A bear market like 2018 could be triggered by an altcoin price bottoming out in the coming days. Let’s take a look at what analysts say about this disaster…

Analysts expect 60% drop in this altcoin project

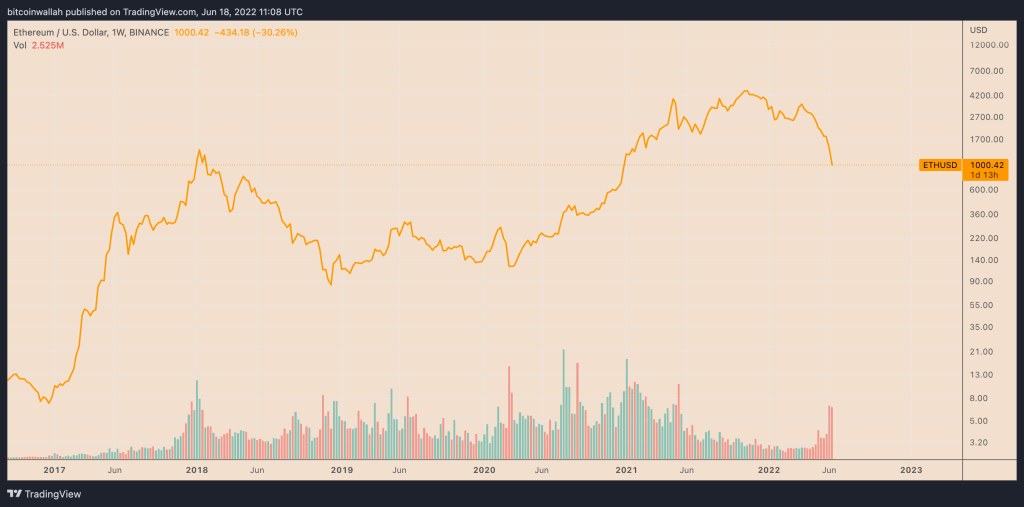

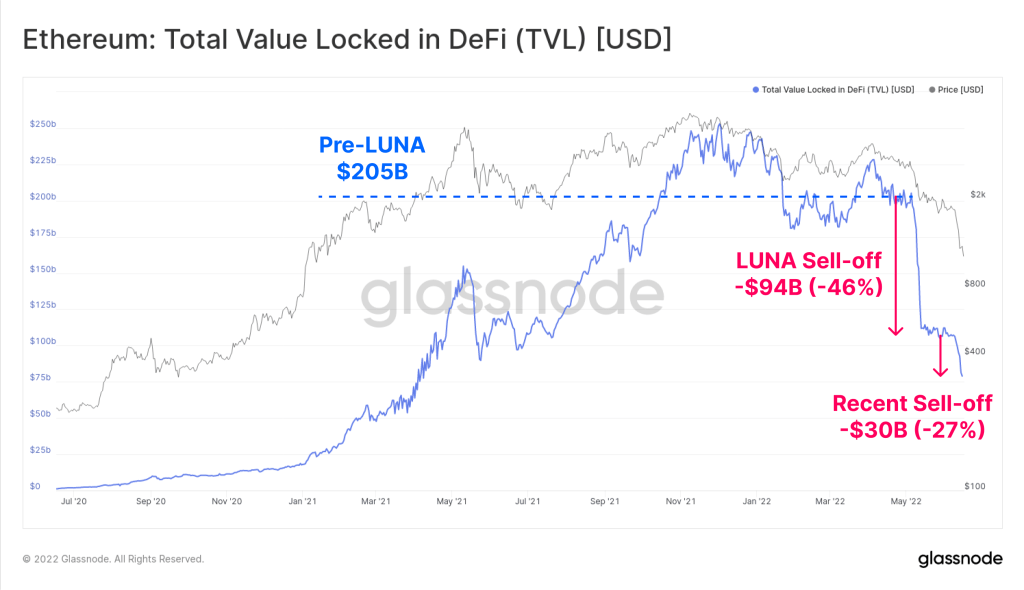

Ethereum price dropped below $1,000 on June 18 as selling continued despite the weekend. ETH hits $975, its lowest level since January 2021. At the same time, it lost 80% of its value from a record high in November 2021. The decline came amid concerns about the Federal Reserve’s 75 basis point rate hike.

Nick, an analyst at data source Ecoinometrics, has this to say about the Fed effect:

The Federal Reserve has yet to start raising rates. According to the records, they didn’t sell anything on their balance sheet either.

The analyst warned that there will be more negativity with these statements.

Ethereum crash continues

Investors have been watching the Ethereum price with concern in recent days. Meanwhile, they fear that a definitive drop below $1,000 will trigger a forced liquidation of massively leveraged positions. In turn, this will put more downward pressure on Ethereum. Fears arise due to Babel Finance and Celsius Network, a pair of crypto lending platforms that have stopped withdrawals citing market volatility…

Three Arrow Capital, a crypto hedge fund that manages $10 billion in assets as of May, is on the verge of bankruptcy. Now this situation has intensified even more after he was unable to support his collateral to hold his positions. The bankruptcy news comes less than a month after Terra, a $40 billion “algorithmic stablecoin” project, collapsed.

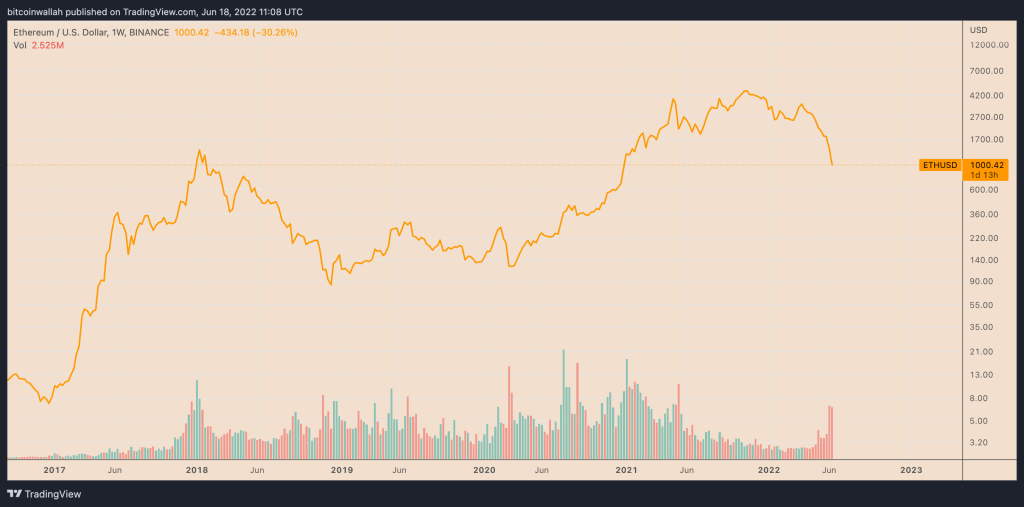

These events coincide with a massive withdrawal of capital from Ethereum’s ecosystem. TLV dissolution occurred in two parts. First, Ethereum’s TVL in DeFi projects is $94 billion after the Terra fiasco in May. It then dropped another $30 billion from that level to mid-June.

CheckMate and CryptoVizArt, a pair of analysts at Glassnode, an on-chain analytics platform, say:

The ongoing debt reduction event is observably painful. This situation looks like some kind of mini-financial crisis. However, with that pain comes an opportunity to let go of excessive leverage and allow for healthier restructuring on the other side.

How much more at risk is the leading altcoin?

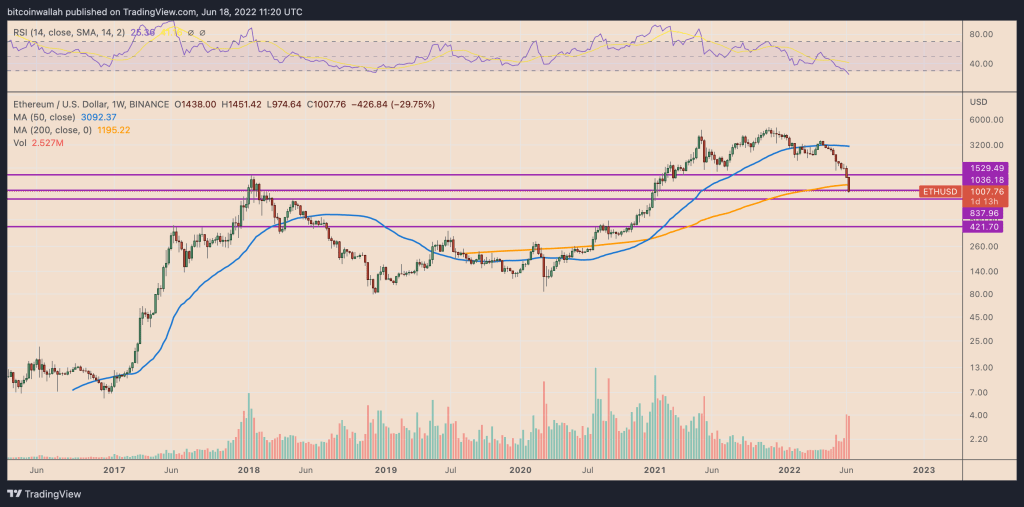

The Fed’s hawkish policies and the continued DeFi market boom point to bearish moves for Ethereum.

From a technical standpoint, ETH’s price needs to recover $1,000 as its psychological support. If it breaks down from this level, $830 will be the next target. The same level acted as resistance in February 2018. This preceded a 90% drop to around $80 in December 2018.

In the meantime, as we quoted by Kriptokoin.com , if something similar to the 2018 bear cycle occurs when the ETH drop reaches over 90%, the price may drop as low as $420. Interestingly, the downside target of $420 acted as support in April-July 2018 and resistance in August-September 2020.