This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

(CoinDesk)

Top Stories

JPMorgan said it is cautious about cryptocurrency markets into 2024, but expects ether to outperform bitcoin and other cryptocurrencies due to an upgrade that will make the Ethereum blockchain more scalable. The SEC’s decision on approving a spot BTC ETF is unlikely to spur major gains as there is a “high chance of buy-the-rumor/sell-the-fact effect,” JPMorgan analysts wrote on Wednesday. Ether is likely to shine due to the EIP-4844 upgrade, or proto-danksharding. That’s a development of sharding – splitting the network into shards to improve transaction speed – by way of Danksharding, which uses the shards to increase space for groups of data. Proto-danksharding involves adding a new transaction type to Ethereum: the “blob-carrying transaction.”

Cathie Wood’s investment firm, ARK Invest, offloaded a sizeable chunk of Coinbase as the shares of the Nasdaq-listed crypto exchange rose to a 20-month high on Wednesday. ARK sold 283,104 shares worth $42.6 million based on Coinbase’s last close of $150.46. The firm has sold over $150 million worth of the shares since Dec. 5. On Wednesday, COIN rose more than 7.7% to top $150 for the first time since April 2022. Despite recent sales, the exchange still constitutes over 10% of ARK’s portfolio and retains the top spot on the investment firm’s list of top 10 holdings. The investment firm also sold some $1.63 million shares of Grayscale Bitcoin Trust.

The value locked on Cardano’s ecosystem grew rapidly in the past few weeks as a recent boost in Ethereum alternatives is likely pushing crypto investors and users toward other blockchains in search of returns and capital allocation. The total value locked in all Cardano-based projects jumped to over $440 million earlier this week, crossing a previous peak of $330 million set in April. Cardano’s ADA token has surged some 17% in the past 24 hours, extending its monthly gain to almost 80%. The total amount of capital locked or staked across all DeFi protocols reached $50 billion at the start of December for the first time in six months, led by Solana ecosystem protocols as optimism around the blockchain has picked up in recent weeks.

Chart of the Day

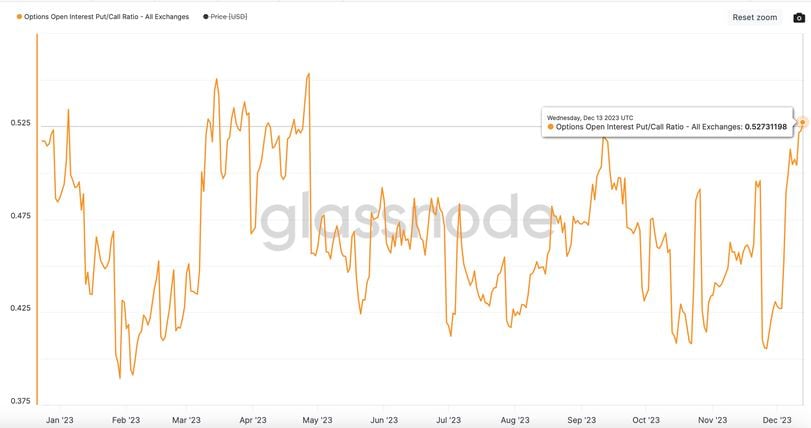

(Glassnode)

– Omkar Godbole

Podcast

Listen to latest news on cryptocurrency

Markets Daily Crypto Roundup

Crypto Update | What’s Behind the Weekend’s Price Correction