Greed has become a dominant sentiment again after a pullback earlier this week, with most cryptocurrency projects showing bullish signs. However, long/short data from CoinGlass shows that a few cryptocurrencies remain dominated by short positions. However, given the change in sentiment, such a scenario could lead to a ‘short squeeze’ in the derivatives market, according to crypto expert Vinicius Barbosa. The expert states that there is a high short selling volume, especially for 2 altcoins.

The first altcoin with short squeeze potential: Jito (JTO)

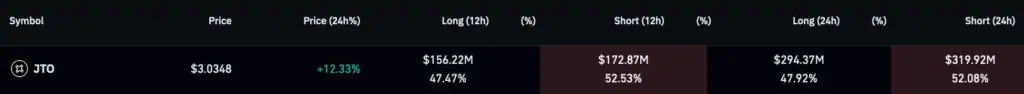

At the time of writing, the JTO token was trading at $3.03, up 12% on a daily basis. Surprisingly, there is still a dominance of short positions over long positions on both the 12- and 24-hour time frames. First, Jito has $172.87 million (52.53%) open interest in the last 12 hours. Secondly, in the broader context there is bearish volume of $319.92 million (52.08%).

JTO 12 and 24 hour Long/Short ratio. Source: CoinGlass

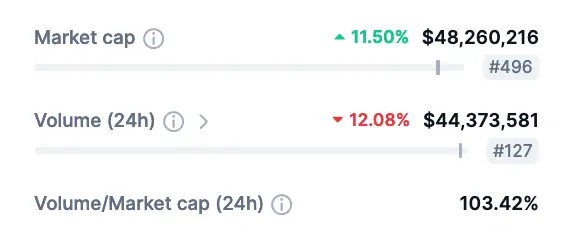

JTO 12 and 24 hour Long/Short ratio. Source: CoinGlassMeanwhile, JTO has a market cap of $349.13 million. Additionally, the daily exchange volume of the altcoin project is at the level of 330.32 million dollars. These are very close values to the $319.92 million short position opened in the last 24 hours. Therefore, it is very likely that he will face a ‘short squeeze’ at any moment.

Jito market cap and volume (24 hours). Source: CoinMarketCap

Jito market cap and volume (24 hours). Source: CoinMarketCapSecond candidate for short squeeze: Unifi Protocol (UNFI)

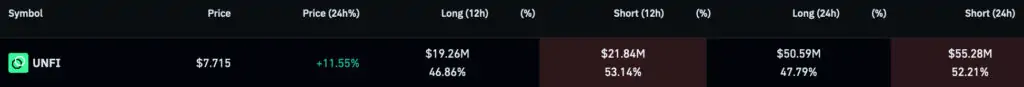

Another altcoin with a possible short squeeze is UNFI, the token of Unifi Protocol DAO. According to CoinMarketCap, its 24-hour volume is just $4 million behind the $48.26 million capitalization. This suggests significant trading interest has increased for UNFI, which is still heavily weighted towards short positions. Interestingly, $21.84 million (53.14%) and $55.28 million (52.21%) were shorted in the last 12 and 24 hours, respectively.

Unifi Protocol DAO market cap and volume (24 hours). Source: CoinMarketCap

Unifi Protocol DAO market cap and volume (24 hours). Source: CoinMarketCapNotably, short selling volume exceeded the token exchange volume during the day. Meanwhile, UNFI was trading at $7.71 at the time of writing, up 11.55% on its daily chart. If the altcoin price continues in its upward trend, short sellers may be liquidated on a massive scale, causing a major impact on their markets.

UNFI 12 and 24 hour Long/Short ratio. Source: CoinGlass

UNFI 12 and 24 hour Long/Short ratio. Source: CoinGlassEssentially, increased demand causes a high volume of buy orders to liquidate exchange books, pumping up the price. It also triggers derivative contracts for liquidation, pushing the altcoin price even higher. All things considered, there is no guarantee that these two cryptocurrencies will be short squeezed.

The opinions and predictions in the article belong to the expert and are definitely not investment advice. cryptokoin.comWe strongly recommend that you do your own research before investing.