Many Arbitrum projects are experiencing significant growth in terms of user numbers, transactions and revenue growth. In this article, let’s take a look at the prominent projects of the Arbitrum network from the list of DeFi analysts…

Here are the 7 best altcoin projects from the Arbitrum network

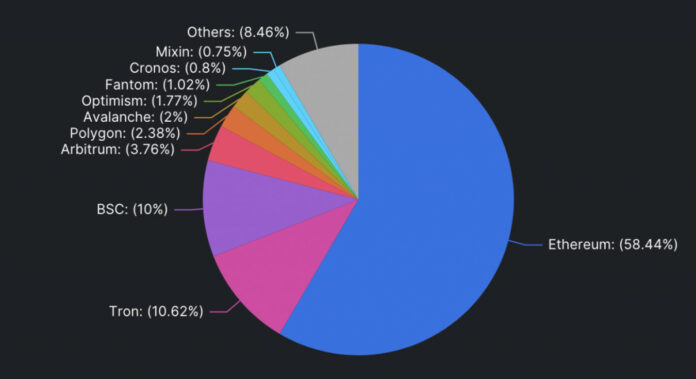

Arbitrum is developing a robust ecosystem considering the competition in the Tier-2 Blockchain industry. However, its broad EVM compatibility, including Solidity and Vyper, has made it one of the most promising EVM compatible rollup technologies. It has also already partnered with a wide variety of Ethereum decentralized applications (dApps) and infrastructure projects. These include Uniswap, Sushi, DODO and other giants.

So which are the best Arbitrum projects? In the rest of the article, let’s answer this question from the list of Altcoinbuzz analysts by examining how they work and where the Arbitrum ecosystem will go next.

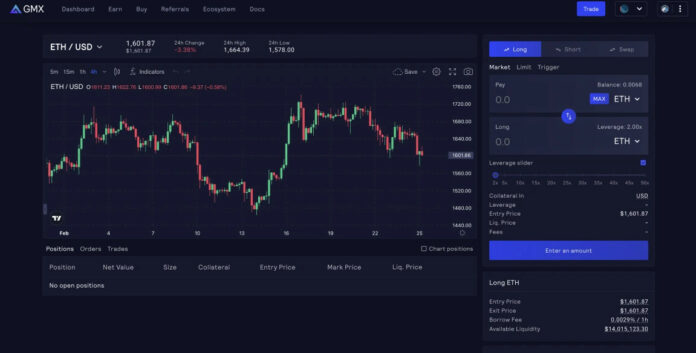

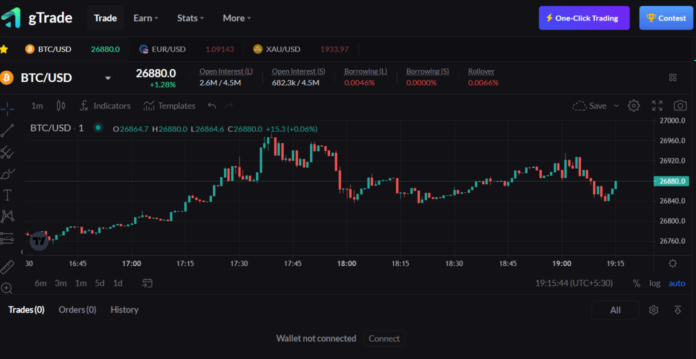

GMX (GMX)

GMX has become the leading perpetual exchange in DeFi with its zero price-impact trades, limit orders, low clearing fees, and liquidation-safe positions. It attracts a significant number of active users and forges strong partnerships in the cryptocurrency space. The DEX exchange provides traders with features such as spot swaps and continuous leverage of up to 50x. It is the largest protocol in the Arbitrum network, with a TVL of approximately $500 million:

- It focuses on zero price-effective transactions and low clearing fees.

- Trades are facilitated through a multi-asset pool called GLP, which pays liquidity providers for their services.

- It uses Chainlink Oracles to provide dynamic pricing.

GMX allows its investors to participate in voting on proposals. It is currently traded on exchanges such as Binance, KuCoin, and OKX. As such, it is well positioned to expand with more liquidity entering Arbitrum due to its binary swap model and community-created tools. This also functions as an LPers playground.

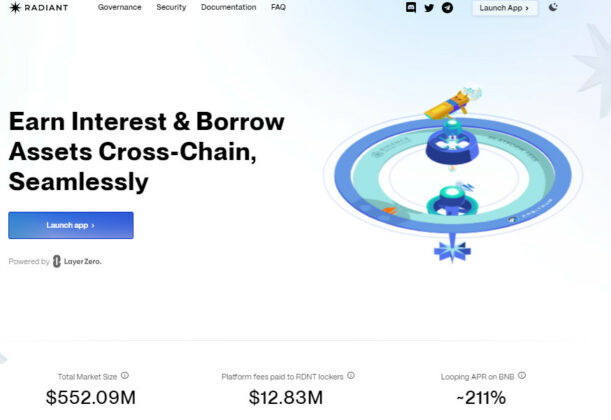

Radiant (RXD)

Radiant is a multi-chain DeFi platform that allows users to deposit any large asset on any Blockchain and borrow assets supported across multiple networks. Its mission is to consolidate liquidity in the best Tier 1 and Tier 2 protocols.

Thus, lenders can gain value through the native token RDNT. The primary goal of the Radiant DAO is to consolidate the $22 billion fragmented liquidity currently scattered across the top ten alternative tiers.

Gains Network (GNS)

Gains Network is a decentralized exchange that allows trading of various assets with high leverage of up to 150x in cryptos, 1000x in forex, 100x in stocks, 35x in indices and 250x in commodities. It has reached more than 100,000 users with a transaction volume of $29 billion since its inception. Some features:

- There is no order book or liquidity for every pair, but there is a single gDAI vault for all listed trading pairs.

- Synthetic leverage is used, and DAI vault and GNS take back leverage.

- It uses a private real-time Chainlink decentralized Oracle network to get the median price for each trading order.

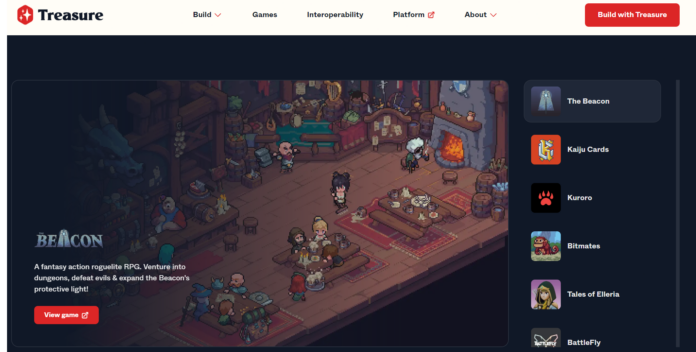

TreasureDAO

Treasure is a decentralized NFT ecosystem built for metaverse projects on the Arbitrum network. NFT marketplace Trove has raised over $250 million in total market volume to date. The cryptocurrency of the Treasure NFT market is MAGIC. It also serves as a bridge currency for future projects within the ecosystem.

Some of the key features of Treasure are as follows:

- Treasure is a marketplace for trading cryptocurrencies such as NFTs and other collectibles.

- It provides instant liquidity access for those who want to convert their NFTs into other crypto assets such as MAGIC.

- The market offers a variety of game collections, avatars and assets with vital data such as scarcity, usage and title of origin.

- It also shows bidding activity and ownership history, which can add to the value of the asset in the market.

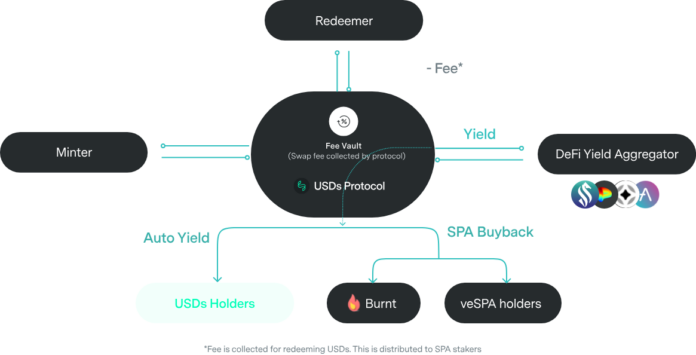

Sperax (SPA)

USDs is a stablecoin that provides automatic returns locally and is distributed on Arbitrum. It is also Ethereum’s largest Layer-2 Ecosystem. It earned $20 million TVL in the first 2 months since its launch.

SPA is the management and value accrual token of the Sperax ecosystem. SPA owners can stake SPA to get and SPA.

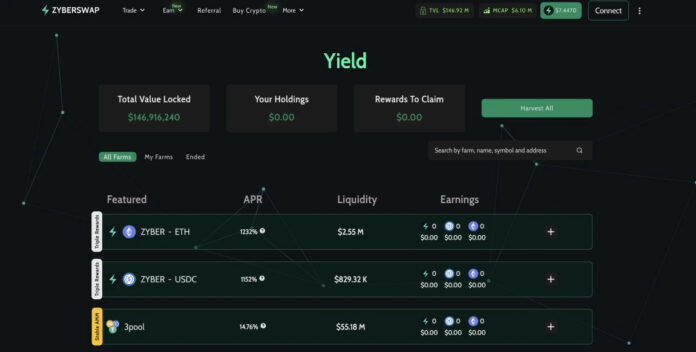

Zyberswap (ZYB)

This platform is an Arbitrum-based decentralized exchange (DEX). It offers an automated market maker (AMM) and low fees to trade crypto assets. It also provides rewards for staking and yield farming across the entire Arbitrum network, with all major changes decided by management voting.

In addition, the platform has passed a comprehensive security audit. It is incubated by Solidproof, which provides free auditing and KYC processes for new projects.

Jones DAO (JONES)

Jones DAO is a proprietary protocol for optimizing liquidity and return by offering enterprise-grade strategies through its vaults. Using yield tokens, each strategy not only increases liquidity and efficiency, but also unlocks capital for DeFi. This vital feature distinguishes Jones DAO from other protocols and can generate lucrative returns for its users.

The protocol addresses three different groups:

- Those who do not prefer to actively manage their strategies. These are users who want to take advantage of the predetermined strategies offered by the cashiers.

- Users who prioritize liquidity and prefer to keep their tokens liquid rather than locked.

- Users who want to earn additional returns on their treasury positions.

last words

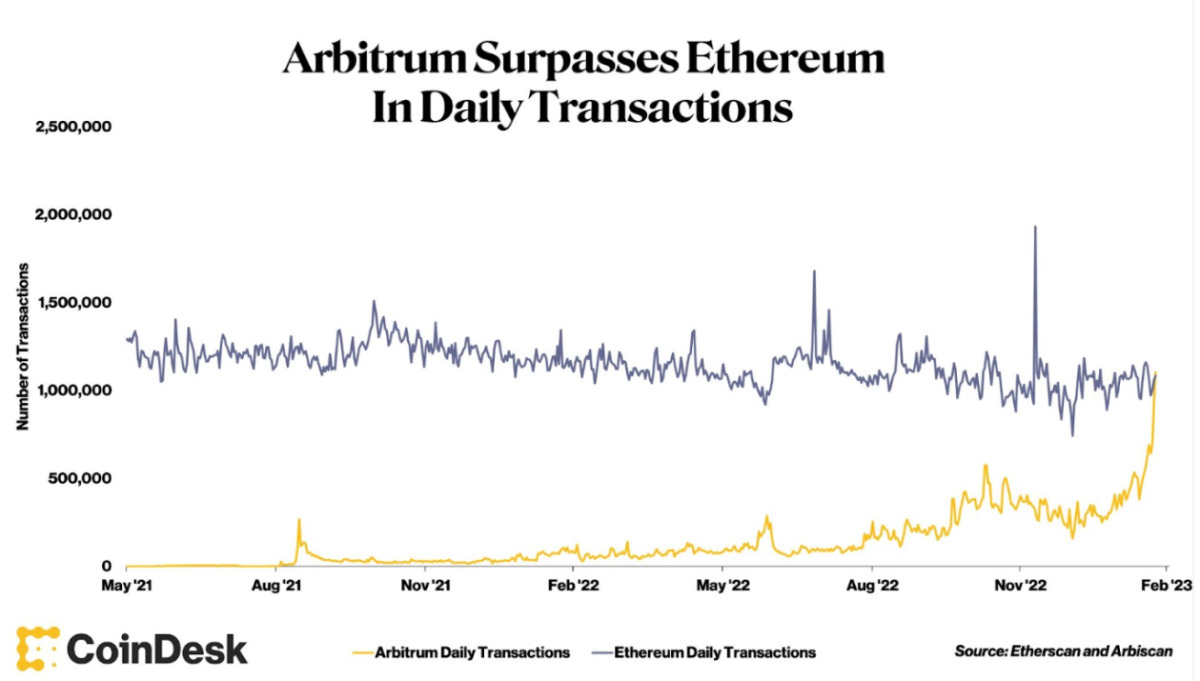

Arbitrum is a premium Ethereum scaling solution with TVL, user adoption and diverse dApps ecosystem. In February 2023, Arbitrum surpassed Ethereum in daily trading volume for the first time in history. This remarkable achievement serves as a testament to Arbitrum’s growing popularity within the crypto community.

cryptocoin.comAs you can follow, it continues its recent rise with the support of big investors.