Crypto analysts are warning against intense shorting on the altcoin project that will release $200 million worth of tokens next month.

Attention on this date, $200 million will be dumped into the market

Permanently focused decentralized exchange dYdx will unlock 150 million, or approximately $200 million worth of DYDX tokens, on February 2. This can be a potential selling opportunity for traders. However, some analysts warn against taking a shoty position, saying that the supply version is not necessarily bearish. According to Charles Stry, head of growth at crypto index platform Phuture:

While the upcoming token unlocks will give venture capitalists investing in the project access to some of their token allocations, the market thinks they will likely hold rather than sell, continuing to show support for DYDX and signaling their commitment to the community.

Token unlock refers to the process of releasing blocked tokens as part of project funding rounds or fundraising efforts. According to CoinGecko, the DYDX supply will be fully unlocked by September 2026. cryptocoin.com As we reported, this year Ripple is preparing to launch a large amount of tokens in Filecoin and Optimism. While token unlocks often create selling pressure, in some cases they can put short traders on the line.

Decentralized platforms more prominent since FTX bankruptcy

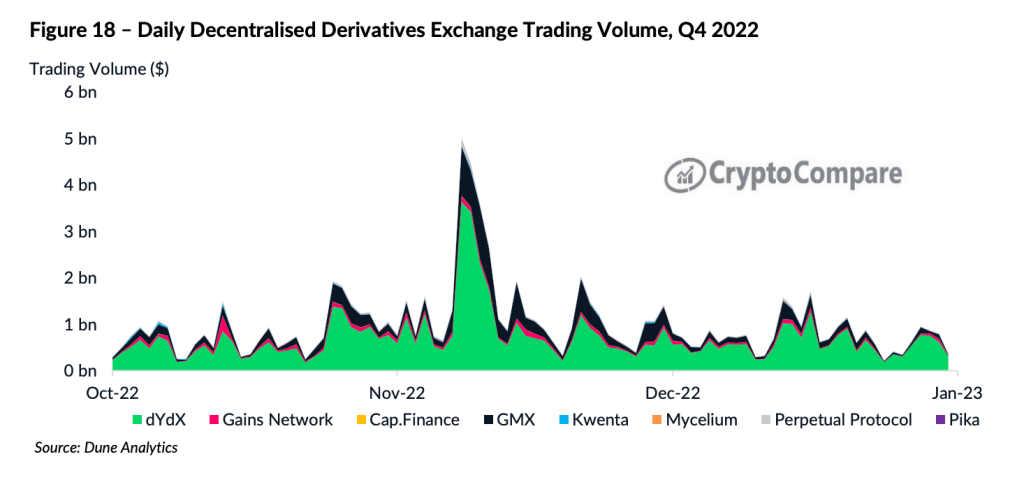

Activity on decentralized exchanges such as dYdX and GMX, which offer perpetual futures, has gained momentum since the collapse of centralized derivatives giant FTX. Trading volume on dYdX rose to $2.9 billion on January 14, after falling to $212 million following the development of FTX, according to data from Nomics. Perpetuals or perpetual transactions are futures contracts that have no expiration date. This allows both bull and bear traders to hold their long/short positions for as long as they want.

Switching from CeFi to DeFi

The shift from centralized derivatives exchanges to decentralized derivatives exchanges is likely to pick up speed this year due to the collapse of some centralized exchanges like FTX. CryptoCompare, in its 2023 outlook, has this to say about it:

Decentralized derivatives and perpetual exchanges are another area in DeFi that is poised for growth this year… It has been fascinating to watch the rise of GMX in the second half of 2022. Since then, several new derivatives exchanges have been launched, including Gains Network and Perpetual Protocol, and will currently compete with GMX for the throne of dYdX. These exchanges have seen an increase in their user base since the collapse of FTX.

What should altcoin investors expect?

Crypto Miles Deutscher said in a tweet that before unlocking dYdX, it is better to go net long as shorting becomes “over-short”. However, David Scheuermann, a trader at Crypto Finance AG, said “this is a dangerous move in a market where there is a lot of upward momentum,” referring to the widespread shorting of tokens prior to unlocking.

Following the slump in prices after FTX crashed, the broader crypto market also saw an uptick last month. Meanwhile, DYDX was trading between $1.12 and $1.58. “I think the significant rise in price is definitely due to some recent upward movement in major tokens,” says Christopher Newhouse, crypto derivatives trader from GSR. Scheuermann expressed a similar view, saying that the positive price action in the market has eliminated short positions that started in December.