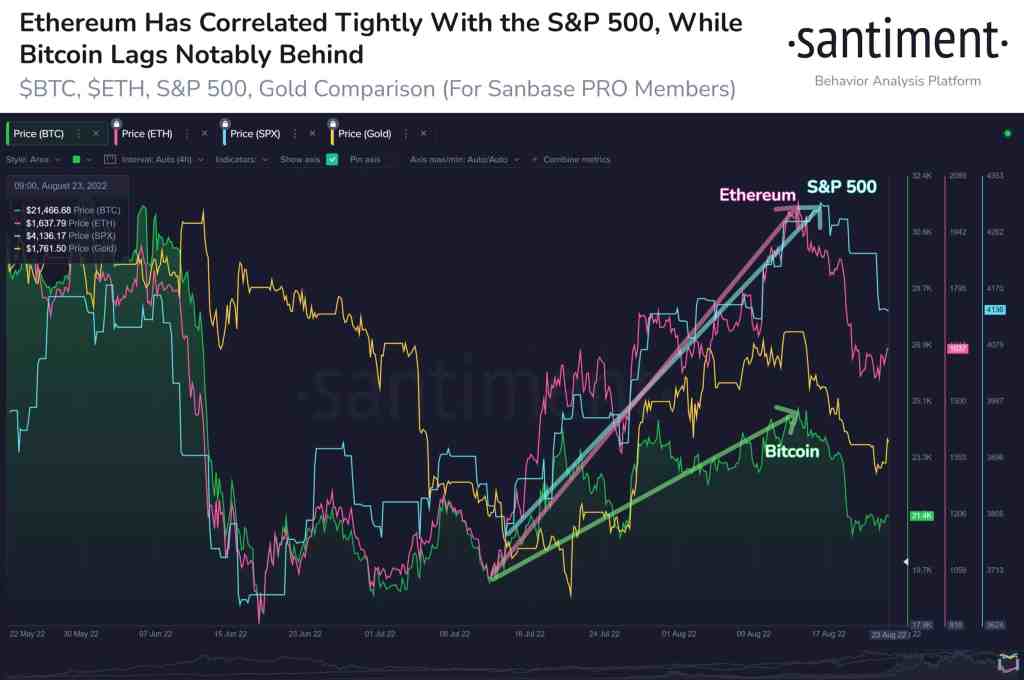

Bitcoin (BTC) attracted attention with its relationship with the S&P 500 in the last quarter of 2021. However, an altcoin appears to be more correlated with US tech stocks.

Not Bitcoin, this altcoin correlates stronger with S&P 500

The entire crypto market, including Bitcoin (BTC), has been under selling pressure over the past week. The unfavorable atmosphere comes as the anxious global macroeconomic conditions persist due to the Fed’s expected rate hike next month. Ethereum, the largest altcoin by market cap, is winning the race over Bitcoin, which previously showed a significant correlation with the S&P 500. According to on-chain data provider Santiment, when the ETH price surged ahead of the much-anticipated merge update, it began to have a stronger correlation with the blue-chip US market index. Santiment underlines the following in their analysis:

In mid-August, Ethereum and SP500 returned to their May price levels. But Bitcoin hasn’t caught up yet.

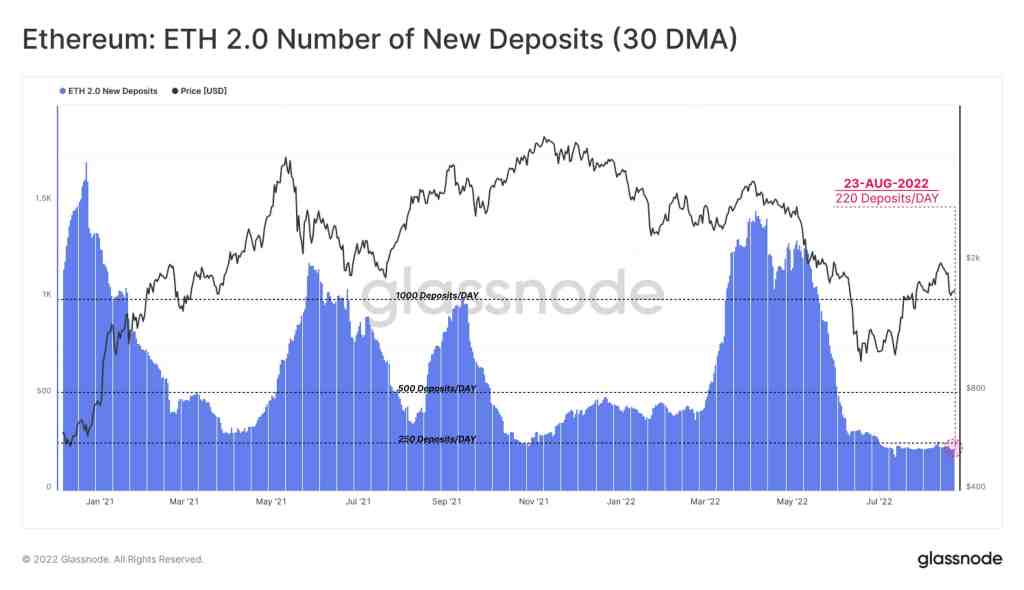

The entire amount of ETH staked on the Ethereum 2.0 Beacon Chain has now reached a normal level with the recent increase in ETH price. According to data provided by Glassnode:

At 220 deposits per day, the amount of ETH invested in the Beacon Chain contract is currently consistent but macro-low. This indicates that a stable holding pattern has been reached as investors wait for the successful merge expected in mid-September.

The long-awaited merge upgrade coming next month is in the limelight of the entire crypto community. cryptocoin.com As you followed, two Ethereum clients, Go Ethereum and Nethermind, discovered issues with the Mainnet Merge updates. Yet they seem to be under the control of Ethereum developers. It is also not expected at this time to cause further delay in the merge upgrade.

Investors focus on altcoin market

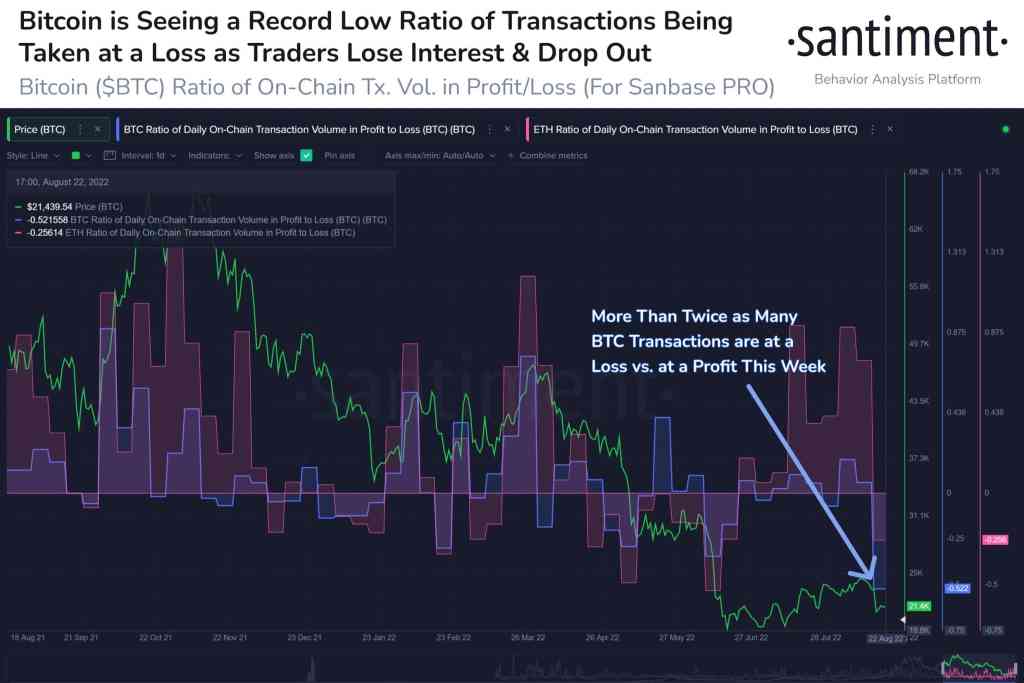

On-chain data source Santiment says investors are less interested in Bitcoin. Investments are focusing more on the altcoin market instead. Santiment says in a tweet on the subject:

Since temporarily surging above $25,000 on August 14, Bitcoin price has plummeted. Transactions in BTC are often made at a loss, as the focus of investors shifts to Ethereum and altcoins. The take profit rate is at its lowest point in history at this point.

Ethereum technical analysis

Ethereum is down 20% over the past week after encountering resistance at the overhead resistance of $2000. However, buyers regain trend control at $1600. They are also preparing for another test to push the price above $2000. On the technical side, the DI lines are showing weakness in the downtrend as the market price remains near $1600. Also, the price is gaining strength to the demand level of 1600, while the RSI slope shows positive rebound in the oversold zone. The 14-day SMA marks a sharp drop in the underlying bullish due to last week’s crash. Brian Bollinger has identified the following technical levels for current conditions in his current technical analysis.

- Resistance level – 1733 and 2000 dollars

- Support level – $1600 and $1426