Global giant Digital Currency Group ( DCG), FTXIt is struggling with the financial problems experienced in its sub-companies with the effect of the events.

In the crypto industry FTX The effects of the bankruptcy are felt intensely. One of the world’s largest cryptocurrency exchanges FTX , reset in a very short time. Daily 10 billion dollarsExchange with a trading volume of more than Alameda It suffered a major bankruptcy. Once upon a time 60 billion dollarsThe company, which managed to reach value, shook the agenda by being reset in a short time. FTXand Alameda‘s collapse brought the end of subsidiaries. BlockFi became the subsidiary that filed the subsequent bankruptcy filing. Investors who consider all these processes, Genesis He is very concerned about his problems. because Genesis, grayscaleand Coindeskincluding companies such as Digital Currency Groupbelonging to

Genesis Company’s Lending Platform Starts The Trouble

last month Genesiscompany’s credit platform FTX He stopped withdrawals, citing his collapse. Unable to pay off its customers’ millions of dollars in assets company armstated that it will not be able to make redemptions and new loan purchases.

Genesis Global capitaland Genesis Global TradingThe company, which has two different managements, capitalHe stated that the party has stopped the withdrawal process. CEOAccording to the statement of Genesis‘of Trading foot continues independently. The event that does not affect the parent company and the trading leg, capitalattributed to the liquidity problems on the side.

Genesis capitalto this problem that broke out on the side of 50 billion dollarsfrom the Digital Currency Group (which manages an asset) DCG) did not receive any intervention. grayscaleowner of a giant company such as DCG, Genesis Capitaldid not solve or could not solve the problems on the side.

Genesis Searches for Liquidity

lending platform Genesis Global Capital started to seek liquidity after stopping withdrawals. from its parent company or Genesis GlobalIt was also noteworthy that there was no intervention from the side.

Another eruption in a short time Geminicame by. Geminiand Genesisrun in partnership Earn protocol was also affected by the problems. According to the statement from Gemini exchange, 900 million dollars a being is trapped inside. In addition, the companies said in a joint statement, EarnThey also reported that they are working together to solve the problems in the protocol.

In the midst of these struggles, Genesis A striking statement came from the company, which stated that there was a problem in only one arm of . Genesis, 1 billion dollars announced that it would go bankrupt if it could not find any assets. to the Gemini side 900 millioncompany with dollar liability, 1 billion dollars demand was seen proportionally. However, the billion-dollar situation, which is seen as the problem of only one line of business, Genesisjumped to.

Genesiswhile seeking liquidity BinanceThe news began to resonate. Binancebefore Genesis He announced that he would buy . as you will remember Binance, FTXHe did the same for her. BinanceCEO Changpeng Zhao ( CZ), FTXHe reversed this decision shortly after he gave the message that he would buy .

Genesisin FTX It was noteworthy that he went his way. Investors have a new FTX They began to think that they might be dealing with a case. However, another question came to mind. Genesis, in grayscaleand Coindeskincluding the Digital Currency Groupbelonged to.

Genesis on the Verge of Bankruptcy

Seeking a billion-dollar fund and stating that he will file bankruptcy if he cannot find it. Genesis, a blow USAseven of its regulators. regulators , began investigating the Genesis company. Audited by many experts, the company FTXIt is being examined against the possibility of experiencing the collapse.

There was also a new move from the crypto company towards the end of last month. Genesis started negotiations with its creditors in order to avoid bankruptcy. Moreover company also knocked on the door of restructuring lawyers. The closure of withdrawals, which was shown as only a minor problem at the beginning of the events, started to grow like an avalanche. But the scenario is the same, the entire crypto industry processes these processes. FTX gained experience on the side. Prior to Alamedacompany liquidityexperienced problems later FTX He also embarked on rescue operations. However, in rescue operations customer fundswere found to be used. Alamedaturned out to be sunken and FTX It was learned that he was also dragged after him. Then they all started falling towards the black hole. These two sister companies also bankrupted hundreds of companies they bought.

Geminito customers 900 millionfound to be owed dollars Genesis A new news has been heard recently. The company’s debt load 2 billion dollars reached around. Creditors and the accumulation of liabilities constantly increase the debt burden of the company.

So why isn’t Grayscale making the move for Genesis?

about 10 billion dollars bitcoinmanaging the existence grayscale, sister company Genesis He didn’t make a move. To make Bitcoin trading easier, Grayscale Bitcoin Trust ( GBTC), the company launched with GenesisHe sufficed to say that they were not affected by the events.

Global investment giant grayscaleIt was a matter of curiosity why the company did not make a move. Alamedaand FTX The two companies, which were compared, refrained from acting together. So why?

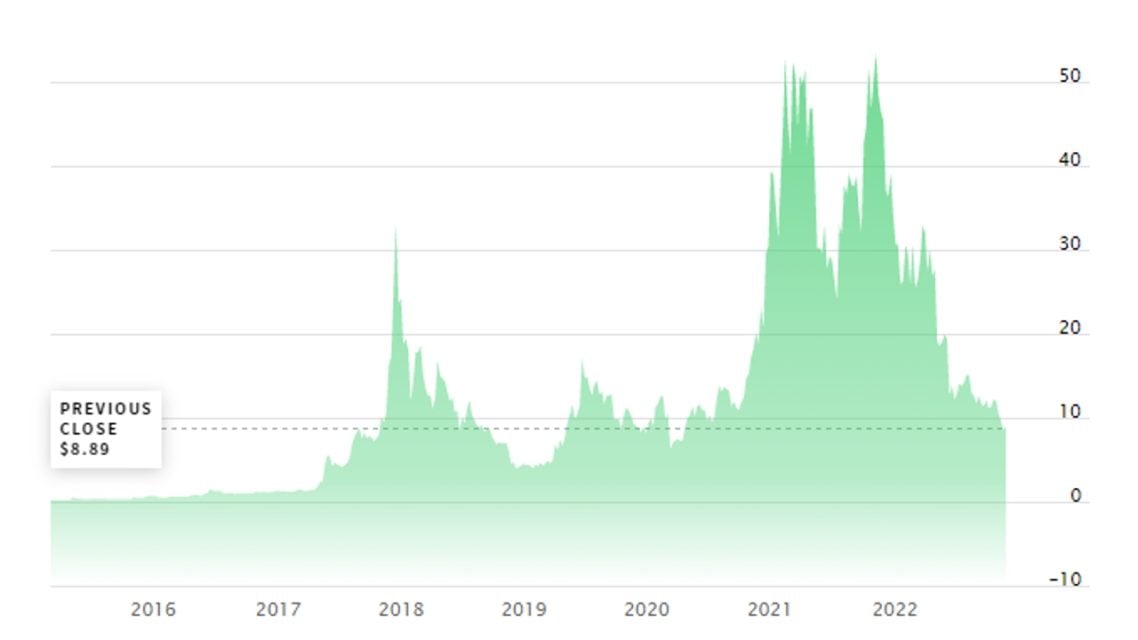

grayscale, Genesisbecause he doesn’t lend a hand GBTC went through troubled processes due to its products. In the past years, it has GBTC attracted great interest and reached a value of billions of dollars. However, these stocks could not avoid the effects of the crypto bear market. With the emergence of different Bitcoin stocks, GBTCinterest in almost 70 percent rate decreased. Almost GBTC craze has been removed to dusty shelves. The effect of this grayscale It was shocking for him too. Although the company was not shaken, it lost power. To the company that works to become a stronger structure, FTXbankruptcy had a devastating effect. FTXinsecure market due to grayscaleaffected its investors.

Grayscale Bitcoin Trust (GBTC) share price

Grayscale Bitcoin Trust (GBTC) share pricea possible collapse scenario and bitcoinconsidering measures against the possibility that the bear market will continue for another year grayscale, Genesisthree monkeys seem to be playing to the side.

If Genesis Fails, Will Grayscale Overthrow?

Approximately 50 billionDigital Currency Group (which manages a dollar asset) DCG ), does not play his cards openly in the face of problems experienced within his body. The giant company did not pay attention to the scenarios on social media.

Yearly 50 millionnews channel with a dollar return CoinDesk, DCGIt is among the companies that ‘s plans to put up for sale. DCG aims to alleviate its debt burden with the income it will generate from this sale. Claims that the news channel will be sold, DCGHe put forward that he actually took the events seriously.

FTXscenario is repeated and Genesis If it goes bankrupt, its sister companies may also be affected. which is far from the strength it had last year. grayscale, GenesisIt is among the companies that will be most affected by the bankruptcy of . Genesis The collapse of ‘s will create an atmosphere of distrust for all partner companies. Serving institutional investors grayscaleIn the face of this situation, the decrease in share prices and GBTCIt may face exits from .

Grayscale Bitcoin Trustshares 55 dollarsfrom levels, 8 dollars dropped to levels. To this shocking effect of market conditions, Genesis bankruptcy can also contribute. The bankruptcy of one of the partner companies is not known to what extent it creates an environment of trust for the others. But investors are in the same game. mate twicedoesn’t want to be.

Will Grayscale Collapse End DCG?

Genesispossible bankruptcy process, grayscale may result in declines in share prices and institutional investor exits. In case of such a situation, grayscaleassets will suffer. DominoEvents that will affect all sister companies with the effect of DCGmay resonate with.

To examine it as a schema;

one- Genesisbankruptcy and billions of dollars in debt obligations DCGto remain.

2- DCGto get rid of debt obligations CoinDesksale of .

3- Due to the panic and fear environment that will arise, grayscaleinvestors withdraw their assets.

4- Exposed to investor exit grayscaleOn the other hand, the substantial drop in share prices.

5- Due to the loss of share value and investor exits, grayscaleliquidity problems that may occur on the side.

6- grayscalein the liquidity problems that occur on the side, DCGdifficulties faced by the party.

7- The giant company, which wants to survive, begins to convert all crypto money into cash.

Domino we can call the stones like this. However, DCGcompany’s 50 billion dollars It should not be forgotten that you are managing an entity. This scenario FTXinterpreted as similar to bankruptcy. FTXcollapse of the executives avariceand investor assetsoccurred due to its use. DCG On the other hand, such problems were not reflected in the press. Only the crisis in assets took place on the agenda.

Also, in this crash scenario, the crypto industry could also be severely injured. Because the company is holding on to crypto assets to stay afloat. to cashwill want to convert.

However, the crypto industry, which has been purged of its bad actors one by one, has the power to become a more reliable industry in the near future.