The gold price reached a one-week high of $1,865 in Asian trading on Tuesday. However, it later declined below the $1,860 level. Still, gold finds support from dovish Fed rate expectations and ongoing Middle East conflicts.

Geopolitical tensions triggered a rush to safe havens

Unlike the United States Dollar (USD), gold price witnessed a one-way winning streak on Monday. It has benefited primarily from its traditional status as a safe haven asset. Thus, it made an upward move with the rise of geopolitical tensions. Following clashes between Palestinian militant group Hamas and Israel, risk aversion was in full swing in the first half of Monday’s trading as investors rushed into safe assets such as the US Dollar, gold, US bonds and the Japanese Yen.

As Fed softens, gold price finds support

Meanwhile, in American trading, markets witnessed a major turnaround in risk sentiment as several Fed policymakers took to the podium and suggested that the recent rise in US Treasury yields was pushing up borrowing costs, which could deter the Fed from considering another rate hike before the end of the year.

“If long-term interest rates remain high due to higher term premiums, there may be less need to raise the Fed funds rate,” Dallas Fed President Lorie Logan said Monday. “Looking ahead, I will be conscious of the tightening in financial conditions through higher bond yields and will keep that in mind as I evaluate the future path of policy,” Fed Vice Chairman Philip N. Jefferson said. The Fed’s conciliatory comments supported risk assets. The US Dollar fell along with US Treasury yields. This provided support for the gold price to recover from seven-month lows.

Gold investors will follow these developments closely

In Tuesday’s transactions, Asian markets were supported by the positive atmosphere coming from Wall Street. Thus, it kept the US Dollar in check on the downside. However, further rise in gold price depends on new developments regarding the Israeli crisis and Fed statements. Meanwhile, Fed officials Raphael Bostic, Christopher Waller, Mary Daly and Neal Kashkari will speak later in the day.

Markets are currently pricing in just a 14% chance of the Fed raising rates at its next policy meeting in November, according to CME Group’s FedWatch Tool. This rate was around 30% the day before. This provides additional support for the gold price.

Gold price technical analysis: ‘Bullish Cross’ is at the door

Market analyst Dhwani Mehta evaluates the technical outlook for gold as follows. As we see on the four-hour chart, the Relative Strength Index (RSI) indicator remains in the overbought zone. This requires caution for buyers. Therefore, the gold price stalled its recovery momentum. However, the 21-Simple Moving Average (SMA) is trying to cross the 50 DMA from below. This shows that a ‘Bullish Cross’ is at the door. Therefore, a minor pullback could be seen in gold price near $1,838. This means a new buying opportunity for optimists.

Gold price four-hour chart

Gold price four-hour chartGold’s breakout above the $1,865 level could trigger a fresh rise towards the key resistance at $1,880, where the 100 SMA crosses the September 28 and 29 highs. Failure to defend confluence support at $1,838 will likely reopen grounds towards $1,811, the recent multi-month low. Before that, the $1,820 round level will provide support to gold buyers.

Gold price forecast: Further rise is not in the cards!

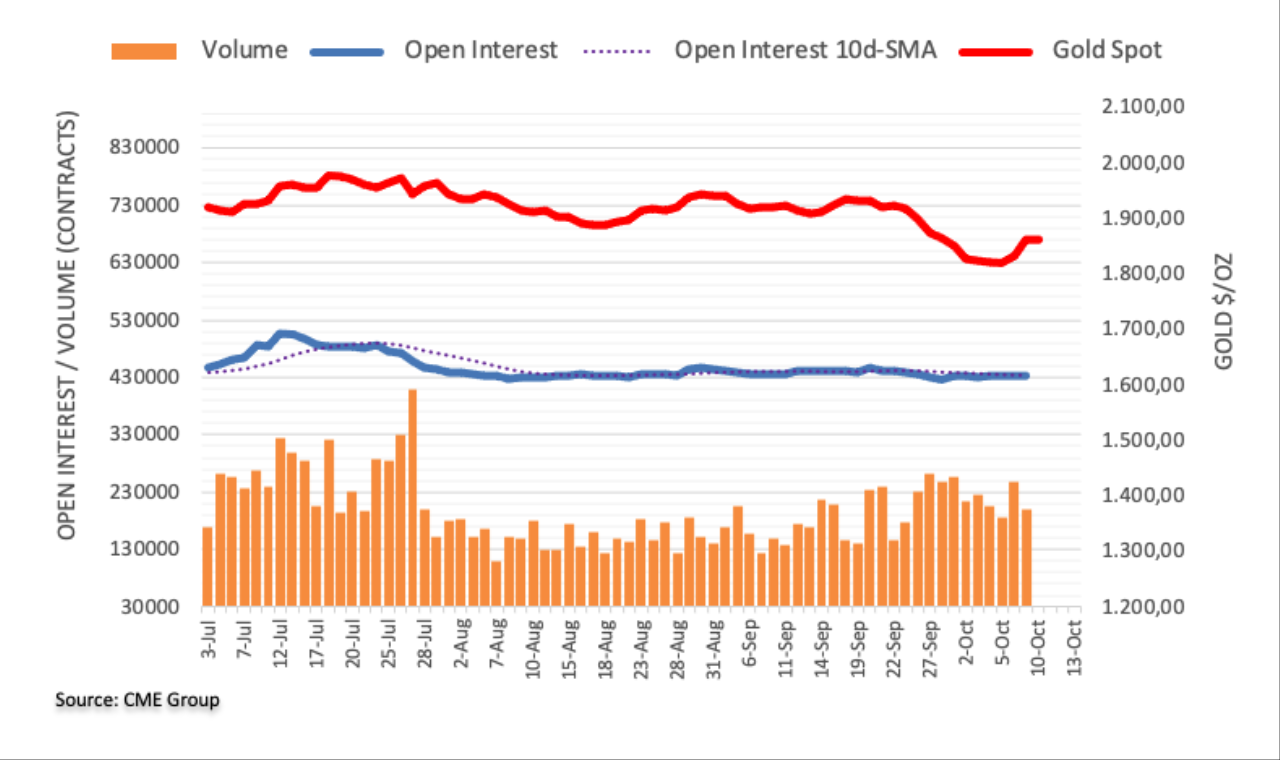

Open interest in gold futures markets decreased by just 495 contracts at the beginning of the week, after three consecutive days of increases, according to preliminary data from CME Group. Volume followed suit. Thus, more than 48 thousand contracts fell after the previous daily increase.

cryptokoin.com As you follow from , the gold price started the week with a strong rise. However, this rise occurred amid shrinking open interest and volume. According to market analyst Pablo Piovano, this was an indication that a continuation of the recovery is not preferred in the very near term. On the upside, immediate resistance emerges near $1,900

To be informed about the latest developments, follow us twitter ‘ in, Facebook in and Instagram Follow on and Telegram And YouTube Join our channel!