The recent upward momentum in Bitcoin’s price has caught many short-term traders off guard, leading to significant losses in leveraged short-term bets. While the value of Bitcoin increased from $39,000 to $44,000, short sellers suffered losses of approximately $90 million in a single day. This sudden market move was fueled by a combination of factors such as increased trading volumes, open interest growth and significant developments in the cryptocurrency space. Meanwhile, it was revealed that Etheruem was actually the focus of Bitcoin investors. Here are the details…

Short selling traders lost $90 million

On Tuesday alone, short-term investors betting against higher Bitcoin prices suffered a collective loss of nearly $90 million. As reported by data source CoinGlass, this loss followed a $70 million short liquidation the previous day. The rise in Bitcoin price from $39,000 to $44,000 at the beginning of the week caused many short investors to grapple with unexpected market dynamics.

Liquidations, which mean the forced closing of leveraged positions due to margin loss, have played an important role in shaping recent market trends. Major liquidations on major cryptocurrency exchanges such as Binance, OKX, and Huobi have contributed to the resilience of Bitcoin’s value. Such liquidation events often provide valuable information for investors by indicating potential tops or bottoms in price movements.

What factors drove Bitcoin growth?

Various factors are thought to be effective in the recent rise in Bitcoin prices. Optimism surrounding a potential spot exchange-traded fund (ETF) approval in the US, the prospect of interest rate cuts and the possibility of government adoption in major economies added to positive sentiment. Additionally, a significant $200 million BTC futures position over the weekend underscores the high demand for Bitcoin.

$BTC open interest on @BitMEX skyrocketed . +90% in a single day! pic.twitter.com/kKeBqeVQxV

— Coinalyze (@coinalyzetool) December 2, 2023

Market watchers expect Bitcoin prices to surpass the $48,000 level in the coming weeks. Julius de Kempenaer, senior technical analyst at StockCharts.com, underlined the bullish trend with a target near $48,000 and support near $38,000. According to Kempenaer, the recent overcoming of resistance in the $30,000 region has set the stage for this rally.

Ethereum gains momentum

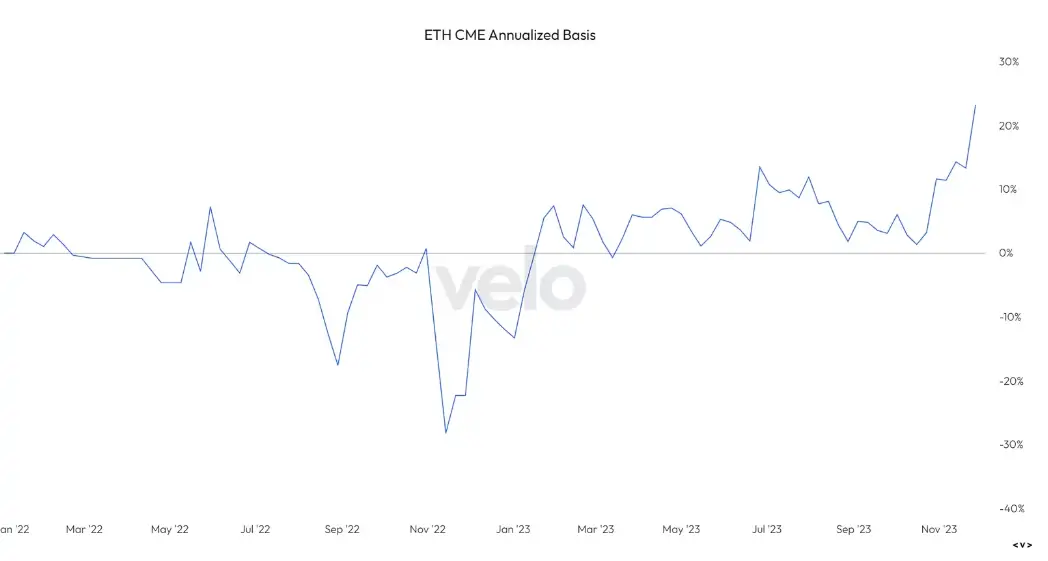

While Bitcoin is up a significant 60% this quarter, attention is shifting to Ethereum (ETH) in the derivatives market. Fundamental metrics show that sophisticated investors are shifting their focus towards Ether, pointing to potential outperformance compared to Bitcoin. The performance gap between the two cryptocurrencies is narrowing, with Ether gaining 35% compared to Bitcoin’s 60% in the same period.

CME futures data reveals that money is flowing into Ether faster than Bitcoin, with nominal open interest in Ether futures increasing by 30% in the last five days to $711 million. This figure surpasses Bitcoin’s 19% increase to $4.9 billion. The positive difference between pricing of Ether and Bitcoin CME futures further supports this trend, pointing to a possible return to ETH ETF trading.