The US 10-year government bond yield exceeding the 3% critical resistance in the Monday session was a yellow alarm for heavily indebted Developing Countries like Turkey. Because, when GOÜ borrows dollars, it pays a country-specific risk premium on top of this return. While the country’s risk premium remains constant, when the US bond yield rises, so does the cost of borrowing the country or company. Again, a second danger for countries like Turkey, whose national currency is defined as fragile, is that the Dollar Index is at its 20-year peak. The rise in the Dollar Index makes it difficult for the CBRT to control the exchange rate, while increasing the TL equivalent of the interest to be paid by banks and non-financial companies borrowing in dollars. That is, not only does foreign credit become more expensive, but the company can allocate an increased portion of its cash flow to financing expenses, and less resources for investment and employment.

This dangerous environment will be priced in all credit and bond markets with the Fed’s 50 basis points hike on Wednesday evening. Turkey’s CDS premium, which exceeded 600 basis points before the Bayram, may increase a little more.

Wait, it’s not over yet. In addition to raising interest rates, the Fed will also sell bonds from its balance sheet, that is, it will withdraw dollars from the market. According to analysis that DIKEN translated from Bloomberg, the G7 countries (Germany, USA, Britain, Italy, France, Japan and Canada) estimate that they will shrink their balance sheets by approximately $410 billion for the remainder of 2022. In other words, not only the dollar supply, but also the Euro supply will slow down and even shrink in 2023. It is possible that the stocks of countries with very low credit ratings such as Turkey will suffer as much as the Fed’s rate hikes during this secondary monetary tightening process.

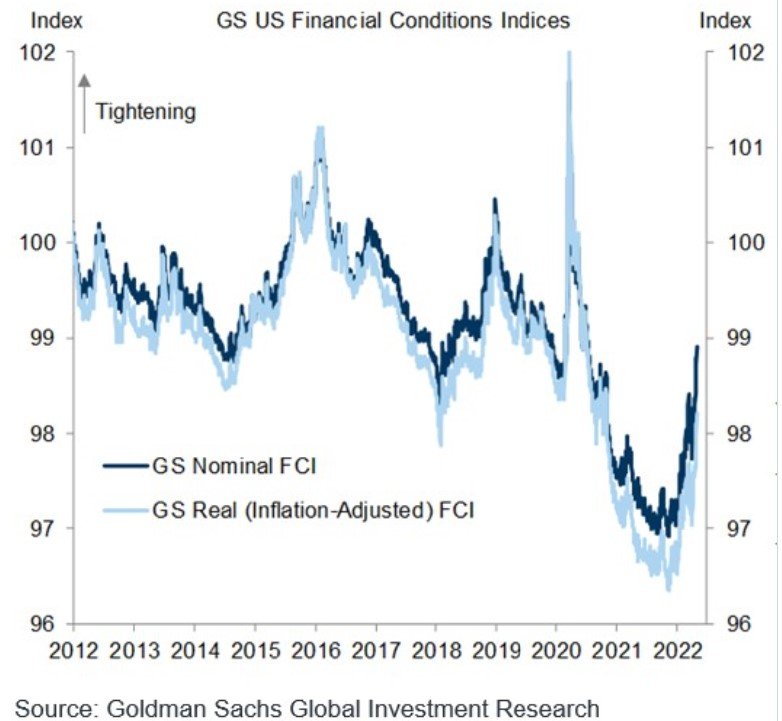

According to Bloomberg, in addition to the moves of the US Federal Reserve (Fed), the shrinkage of 410 billion dollars in the central banks of the G7 countries will also lead to an additional tightening in financial conditions. Economists are worried that this will create a ‘financial shock’.

The dimensions of monetary tightening were also revealed in the Fed’s March meeting minutes. Accordingly, it is stated that the Fed will contract the Treasury balance sheet with $60 billion and the mortgage-backed balance sheet by $35 billion.

Bank will take action at its May meeting

On the other hand, unlike previous tightening cycles where the Fed was alone in shrinking its balance sheet, others are expected to do the same this time around.

Bloomberg estimates that the G7 countries (Germany, USA, Britain, Italy, France, Japan and Canada) will shrink their balance sheets by approximately $410 billion for the remainder of 2022. This means a sharp turn.

The dual impact of shrinking balance sheets and higher interest rates, Russia’s invasion of Ukraine and China’s new Covid-19 quarantines pose an unprecedented challenge for the global economy.

‘Financial shock’

This will increase borrowing costs and melt asset valuations.

“This means a huge financial shock to the world,” said economist Alicia Garcia Herrero, who previously worked at institutions such as the European Central Bank (ECB) and the International Monetary Fund (IMF).

‘First in the history of monetary policy’

The Fed’s rate of contraction in the balance sheet is expected to be twice that of 2017.

According to Gavekal Research manager Didier Darcet, the magnitude and trajectory of the contraction is a first in the history of monetary policy.

A new test

Bond markets, flooded with central bank money since the 2008 financial crisis, now fear the ‘unknown’. Housing prices and cryptocurrencies rising during the ‘easy money’ years will face a new test as the measures tighten.

Matt King, investment strategist at the US-based bank Citigroup, says liquidity flows are much more important than actual returns and are better correlated with stocks. King estimates that every $1 trillion contraction will equate to a roughly 10 percent drop in stocks over the next 12 months.

US 10-year government bond yield broke a 5-year record

Assoc. Baki Demirel: Fed alone cannot prevent inflation

Emerging Market FX succumbs to China