Investors are acting cautiously ahead of Federal Reserve chief Jerome Powell’s speech at the Jackson Hole symposium. Gold prices fell slightly on Wednesday as the US dollar strengthened. Analysts interpret the market and share their forecasts.

“The trend for gold prices is quite bearish”

Spot gold is flat at $1,746.18 at press time, after gaining 0.7% in the previous session. U.S. gold futures were last traded at $1,761.20. Meanwhile, the dollar has gained strength near its recent high against its rivals. Markets will watch carefully Jerome Powell’s speech in Jackson Hole on Friday for more clues to future rate hikes. DailyFX currency strategist Ilya Spivak comments:

We see that Powell’s speech on Friday is something important for the markets at this point. It will provide some kind of guidance or framework on Fed policy. After six days of losses, the market digests the correction. Overall, the macro environment is not materially different. At this stage, the trend for gold is quite bearish.

“This situation opens a door to help gold even more”

cryptocoin.com As you follow, Minneapolis Fed Chairman Neel Kashkari was the latest official to reiterate the US Fed’s focus on controlling inflation above all else. The Fed has increased its benchmark overnight rate by a total of 225 basis points since March. He also noted that further tightening will depend on economic data points.

Sales of new single-family homes in the US fell to a 6-1/2 year low in July. Also, a survey by S&P Global showed that private sector business activity fell to a 27-month low. In an indicator of sentiment, SPDR Gold Trust’s holdings fell 0.3% to 984.38 tons on Tuesday. Edward Moya, senior analyst at OANDA, interprets the data as follows:

Data show that the economy is weakening rapidly. Thus, it signals a major contraction that the Fed may not be that aggressive. This opens a door to help gold even more. Meanwhile, Europe is entering recession and China is slowing down. Gold will finally see safe-haven trading again

“A new spark for gold prices!”

Lukman Otunuga, head of market analysis at FXTM, points out the following technical levels in a market update:

A stronger dollar, rising Treasury rates and fears of a Fed rate hike choked the precious metal. If gold prices exceed $1,724, a sell-off towards $1,700 is possible. Alternatively, a retracement above $1,752 is likely to open a path towards $1,770 and $1,780, respectively.

Otunuga also says it’s possible that Fed Chairman Jerome Powell’s speech on Friday could act as “a new fundamental spark for gold.” Therefore, he notes that the potential for gold volatility is high this week.

“We expect a capitulation event under it”

Precious metals traders focus on President Powell’s speech at the Jackson Hole symposium, according to a report by TD Securities economists. Meanwhile, the last sales of gold continued. Economists make the following assessment:

The Fed is likely to use Jackson Hole to repel the significant easing in financial conditions caused by the President’s recent statements. In line with our view in this direction, precious metal prices started to decline. We also expect this to be the focus of Fedspeak in the coming weeks. This is in line with the recent easing in market expectations for rate cuts right after the rate hike cycle. We also expect a capitulation event in gold as some bullish positions ease.

“The first hurdle for gold prices is $1,775”

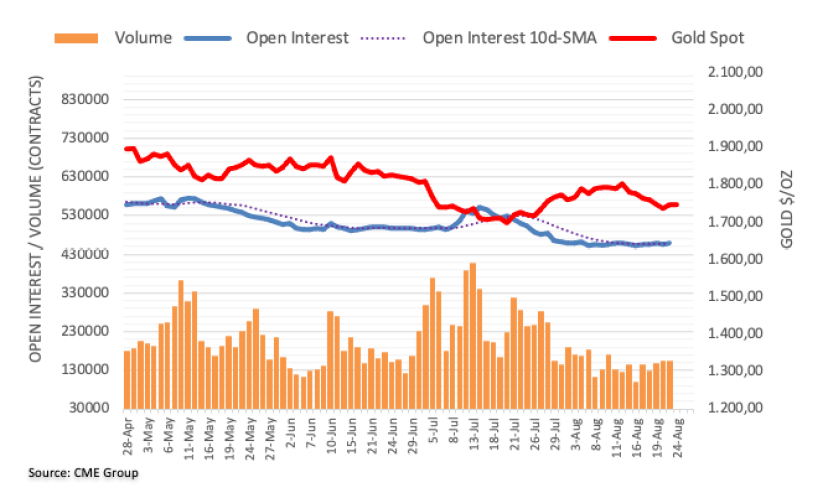

Open interest on gold futures markets rose by 504 contracts, according to preliminary data from CME Group. Thus, the upward trend continued on Tuesday. Instead, volume reversed two consecutive daily gains, shrinking 642 contracts.

Gold prices have regained some stability. The yellow metal retested the $1,750 region on Tuesday, reversing six consecutive sessions with losses. Market analyst Pablo Piovano notes that the rebound was accompanied by a small increase in open interest. According to the analyst, this is an indication that the current bounce may extend further in the very near term. However, the analyst states that the next hurdle is at the 55-day SMA, which is $1,775 today.