Gold prices have surpassed $2,000 multiple times this week. Additionally, prices hovered around these levels Friday afternoon as U.S. traders emerged from their Thanksgiving stupor and returned to metals markets. This time, analysts as well as market participants are expecting an increase.

Bulls gain strength in gold price survey

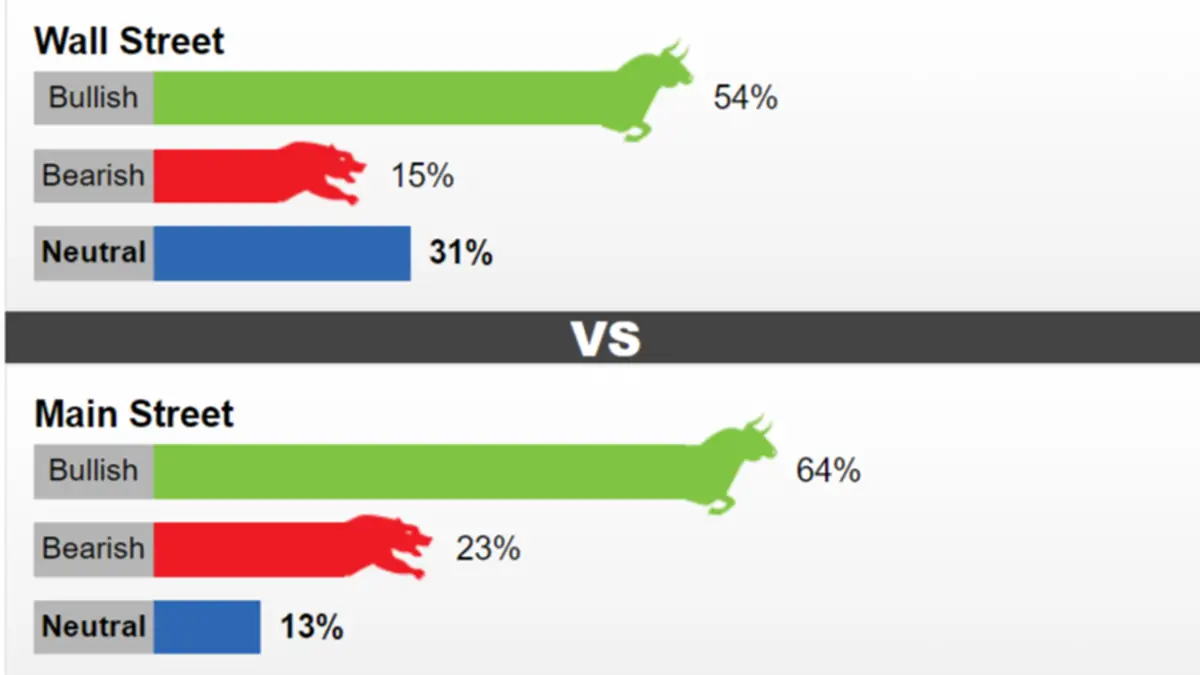

cryptokoin.com As you follow from , gold closed the week above $ 2,000. Retail investors are heading into next week as bullish as ever, according to the latest Kitco Gold Survey. The majority of market analysts also agree with them on the bullish side. However, a significant minority remained neutral on the yellow metal’s near-term prospects. 13 Wall Street analysts voted in the Poll this week. Seven experts (54) expect an increase in gold prices next week. Only two analysts (15%) predict a decline in prices. Four experts (31%) remained neutral on gold for the coming week.

Meanwhile, participants cast 672 votes in online surveys. Market participants were optimistic, as they were in last week’s survey. 431 retail investors (64%) expect gold to rise next week. Another 156 people (23%) predict a decline. 85 respondents (13%) remained neutral on the precious metal’s near-term prospects.

Mark Leibovit: Gold prices will see ATH in 2024!

Mark Leibovit, publisher of VR Metals/Resource Letter, is bullish on gold prices for the coming week. Leibovit leaves no room for doubt on the upside, regardless of US Dollar strength or weakness. Leibovit predicts all-time highs for gold in 2024. But he doesn’t say the same for gold stocks.

Sean Lusk: Gold will profit no matter what

Sean Lusk, co-director of commercial hedging at Walsh Trading, says it’s delusional for markets to think interest rate cuts are imminent. But no matter what, he expects gold to make gains. After some statements, Lusk draws attention to the following levels for gold prices:

… I think gold is gaining some momentum here. It’s a safe haven, uncertainty play, and that’s usually why it rallies. (…) There is a strong resistance near $2,060 on the technical chart. Since the pandemic, there has been a major squeeze phase from $1,730 to $2,070. If we stay above the 200-day moving average at $1,920, you enter a congestion that the market has a hard time breaking. $2,100, $2,075 will be the lower end of this range and it will move up to $2,160.

Frank McGhee: Gold prices will fall because…

Frank McGhee, chief precious metals dealer at Alliance Financial, says gold is overbought. He also expresses his belief that markets have mispriced a number of important factors. McGhee notes that he generally tends to think that weakness will continue underneath. So he doesn’t expect the rally to continue. He says this is only likely to continue for the next few weeks. In this context, McGhee makes the following statements:

It wouldn’t surprise me if one day we suddenly drop $50, $60 and return to the 200-day level. We are overbought. Seasonal factors that would normally support gold prices at this time of year are playing less of a role in the current environment. Typically, the Indian buying season a few weeks earlier is the big seasonal period in the fall. But I think the geopolitical situation is getting in the way of that right now. (…) I expect gold prices to at least retest $1,830 and this will happen as soon as possible.

Adrian Day prefers to remain neutral for now

Adrian Day, President of Adrian Day Asset Management, remains neutral on gold prices. He explains his opinion on this issue as follows:

I remain a bit cautious about gold convincingly breaking $2,000. But this is coming. We still have another Federal Reserve meeting this year where the Fed will aim to talk tough. (…) The Fed will have to relax initially, perhaps on the balance sheet and later on interest rates. (…) Stopping the tightening without overcoming inflation will start a dramatic move for gold.

Marc Chandler: Gold prices may see a limited rise!

Bannockburn Global Forex General Manager Marc Chandler also expects gold to remain flat in a higher channel throughout the next week. That’s why Chandler counts himself among the cautious. “Gold slipped from the support I mentioned last week. However, it did not violate this on a closing basis. “It has also continued to move above $2,000,” Chandler said, noting that the precious metal remains below the $2,009 high seen in October. Based on this, Chandler points out the following levels:

US bond yields softened in the first half of the week and the dollar fell. Also, when it bounced, the upsides were limited and corrective. There could be limited gains in gold towards $2,010. I see support around $1,970.

Darin Newsom: There is time and space above!

Barchart.com Senior Market Analyst Darin Newsom is bullish on gold’s prospects next week. The analyst states that February gold continues to remain in a short-term uptrend on its daily chart. He also shares this assessment:

Daily stochastics are still below the 80% overbought level as of Wednesday’s close. Therefore, there is time and space for it to challenge the previous February high of $2,039.70. Plus, once the US Thanksgiving Holiday has come and gone, Burl Ives’ classic song ‘Silver and Gold’ will be playing almost non-stop on the radio. This may put investors in a buying mood, at least until they get tired of it and start selling again.

Michael Moor: There is upside potential for gold prices

Michael Moor, creator of Moor Analytics, says the technical picture remains bullish in the near term. Moor looks at the following levels:

Transaction above $1,984.6 (-1 tick/hour) gives a good strength alert – we reached 25.2. Beyond this, there is another $30 (+) potential. If we fall below a reasonable level, we could be subject to serious pressure. We are likely in the middle of a bullish structure with a lower time frame.

Jim Wyckoff also maintains bullish stance

Kitco Senior Analyst Jim Wyckoff expects gold prices to rise further next week. “Stead-high as short-term technicals still favor the bulls,” Wyckoff says.